Do you know that, when your employer contributes to EPF then a larger portion of it goes to EPS (Employee Pension Scheme)? In this article, I will elaborate to you what is EPS, how it works and also the process of getting its certificate to claim your pension.

EPS i.e. Employee’s Pension Scheme is actually part of EPF itself, which means it is applicable for all the employees who are contributing towards EPF. This scheme offers a guaranteed and secured pension to the employee after retirement. A nominee can also get the benefit of pension under this scheme after the death of the employee.

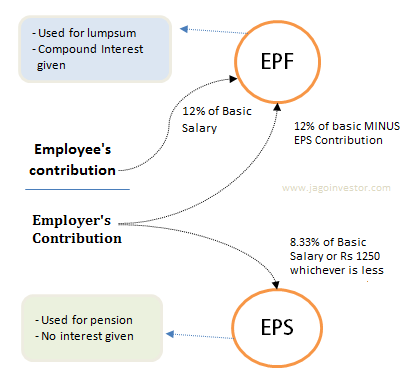

Both employee and the employer contribute equally i.e. 12% of employee’s monthly salary towards employees EPF. However, the 12% which the employer provides, out of that 8.33% goes towards EPS and only remaining 3.67% goes to your EPF.

Diagram showing contribution to EPS and EPF" width="409" height="373" />

Diagram showing contribution to EPS and EPF" width="409" height="373" />

Every employee who has been registered under EPFO can get EPS certificate for claiming his pension. The EPS balance can be either withdrawn after retirement or it can be claimed as pension by opting EPS certificate depending on the tenure of service and the age of the member. So, to elaborate this, I have given some examples below (The length of the service is rounded off to one year if the number of months served is more than 6)

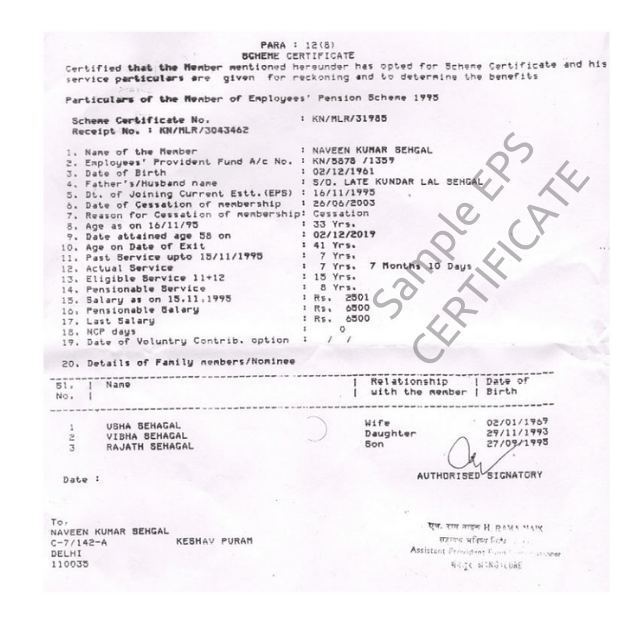

EPS Certificate is a certificate issued by the Employees Provident Fund Organization (EPFO), Ministry of Labour, and Government of India, stating the details of service of the Provident Fund member. The EPS Scheme Certificate shows the service details of the employee, i.e. the number of years he has served and the family details of an employee, i.e. the member of the family who is eligible to get a pension in case of death of the member. As the EPS Scheme Certificate has all the details regarding the service of a member of EPFO, it serves as an authentic record of service.

This is how EPS Certificate looks like:

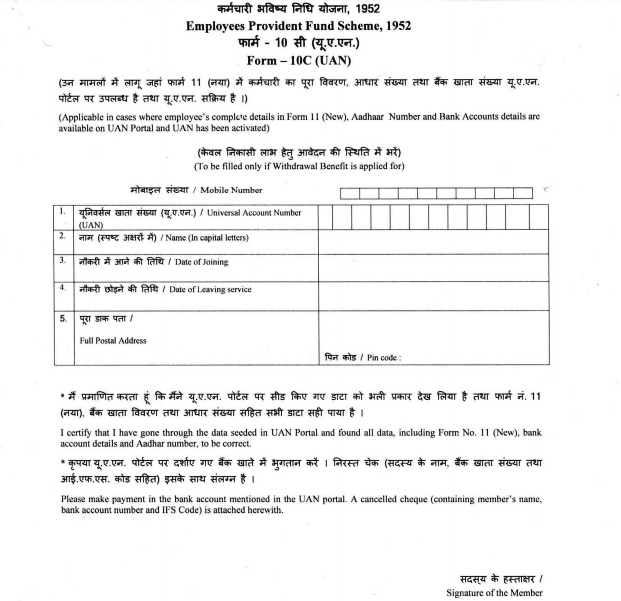

Once you are leaving the job, then you have to fill the Form 10C. In the form 10C, there are options either to withdraw EPS or apply for EPS Scheme Certificate. Once you chose the options to issue EPS Scheme Certificate, then your employer sends the same to EPFO and then EPFO will issue you an EPS Scheme Certificate. If your all inputs are correct, then EPFO will issue you the EPS Scheme Certificate within a month or so.

This is how Form 10C looks like:

I hope this article has helped you in understanding every detail about EPS and its certificate. Let me know if you have any queries or doubts in the comment section.