Updated July 28, 2021 to include the new SBA PPP Direct Forgiveness Portal If you took out a Paycheck Protection Program loan for $150,000 or less, the SBA instructs you to use the PPP Forgiveness Application Form 3508S when applying for forgiveness. Originally this form was for loans of $50,000 or less but the Economic Aid Act, or “stimulus bill,” raised the limit to $150,000. Make sure you are looking at the latest version updated January 19, 2021. This application does not make forgiveness automatic. It appears to be quite simple but it still requires you to calculate your forgiveness amount, which may mean you’ll have to consult other forms. In the past, the SBA has instructed all borrowers to file for forgiveness with the lender that gave them their PPP loan, or the servicer of the loan if applicable. (The lender may use an online form to apply for forgiveness.)

Alert! The SBA’s new online SBA PPP Direct Forgiveness portal allows borrowers with loans of $150,000 or less to apply for forgiveness directly with the SBA.

Even if you use the SBA’s online portal, we recommend you familiarize yourself with this form to understand current forgiveness requirements.

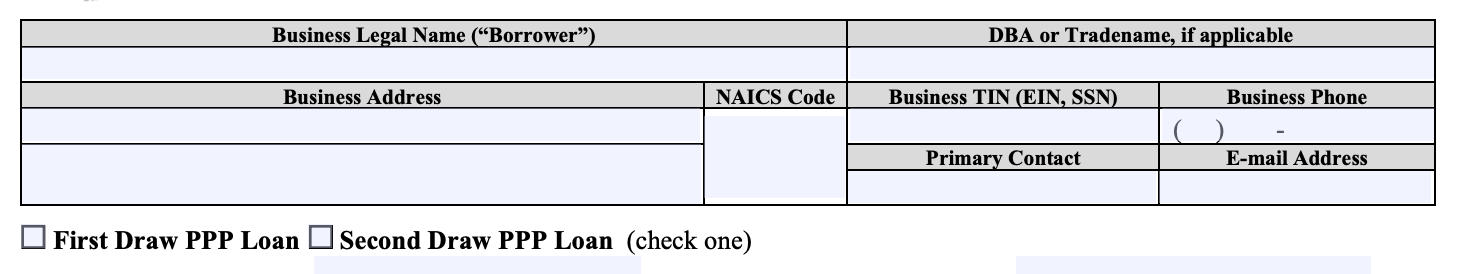

First fill out basic information about your business. Unless your business address has changed, this should be the same as the information you used when you applied for PPP:

If this is your first PPP loan, check the box that says First Draw PPP Loan. If it’s your second PPP loan, check the box that says Second Draw PPP Loan. Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted. SBA PPP Loan Number: ________________________ This is the number assigned by the SBA to your loan. If you don’t have it, ask your lender. Lender PPP Loan Number: __________________________ Enter the loan number assigned to the PPP loan by the Lender. Again, if you don’t know, ask your lender. PPP Loan Amount: _____________________________ This is the amount you received. PPP Loan Disbursement Date: _______________________ Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one. Employees at Time of Loan Application: ___________ Enter the total number of employees at the time of the Borrower’s PPP Loan Application. Employees at Time of Forgiveness Application: ___________ Enter the total number of employees at the time the borrower is applying for loan forgiveness. Covered Period: ________________________ to ________________________

The covered period is the time you have to spend the funds in order to qualify for forgiveness. It starts when the loan is disbursed (into your bank account). Economic Aid Act PPP Flexibility Act changed the Covered Period for purposes of the calculations above. Originally it was 8 weeks, then the PPP Flexibility Act changed it to 8 or 24 weeks, and now, with the Economic Aid Act, the borrower gets to choose a time period of 8—24 weeks. As the application explains…”It ends on a date selected by the Borrower that is at least 8 weeks following the date of loan disbursement and not more than 24 weeks after the date of loan disbursement. For example, if the Borrower received their PPP loan proceeds on Monday, April 20, 2020, the first day of the Covered Period is Monday, April 20, 2020 and the final day of the Covered Period is any date selected by the Borrower between Sunday, June 14, 2020 and Sunday, October 4, 2020.” Choosing the covered period can make a significant difference in terms of how much of your loan is eligible for forgiveness. You will want to choose carefully to maximize forgiveness, and get advice from a legal or accounting professional if you are unsure. We’ll discuss this further in a moment. If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, check here: ☐ Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates ( 85 FR 20817 (April 15, 2020) ) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with affiliates) make sure you review this with your advisors. Amount of Loan Spent on Payroll Costs: _______________ On page two of the application you’ll see a description of eligible payroll costs. It’s pretty straightforward if you have no employees or few employees and haven’t reduced headcount, but you still have to make sure you choose the right covered period to maximize forgiveness. Review the other forms we suggest for calculating forgiveness. Requested Loan Forgiveness Amount: _________________ The application instructions here state: “Enter the total amount of your PPP loan that is eligible for loan forgiveness. This amount is the “Amount of Loan Spent on Payroll Costs” plus any amount spent on eligible nonpayroll costs (described below) minus any required reductions (described below), up to the principal amount of the PPP loan.” It then goes into detail on acceptable nonpayroll expenses. It later reminds the borrower that, “Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount.” This form has been greatly simplified. But what’s likely to be confusing is that you still need to calculate how much of your loan is forgivable, but it’s not laid out step-by-step as with the other forms. How easy it will be to calculate forgiveness depends on your loan amount and other factors, such as whether employee wages and/or headcount were reduced. We’ll provide what we think is a better approach. First an observation:

If your loan amount is less than $50,000 (and affiliates received First Draw PPP Loans or Second Draw loans of less than $2 million) do not have to calculate a reduction in forgiveness for a reduction in employee salaries or wages. The SBA, in the Interim Final Rule originally announcing this form notes that this change is likely to have a minimal impact on overall forgiveness: “There are approximately 3.57 million outstanding PPP loans of $50,000 or less, totaling approximately $62 billion of the $525 billion in PPP loans. Approximately 1.71 million PPP loans of $50,000 or less were made to businesses that reported having zero employees (presumably not counting the owner as an employee) or one employee. To the extent that these businesses have no employees other than the owner…they are not affected by these exemptions.”

On page 3 of the application form you’ll see a notice that “Borrowers that received a PPP loan of more than $50,000 and borrowers of $50,000 or less that together with their affiliates received First Draw or Second Draw PPP Loans totaling $2 million or more must adjust their “Requested Loan Forgiveness Amount” due to statutory requirements concerning reductions in either full-time equivalent employees or employee salary and wages.” If you read it carefully, this is essentially telling you whether you need to follow the calculations in the 3508EZ or 3508 forms, which we describe next.

You can use these forms to calculate your forgiveness amount, then keep those calculations in your records in case the SBA audits your loan in the future.

The application says “The Borrower must comply with all requirements in the Paycheck Protection Program Rules (Sections 7(a)(36), 7(a)(37), and 7A of the Small Business Act, the PPP interim final rules, and SBA guidance issued through the date of this application), and must attest to its compliance on the Loan Forgiveness Application.”

That’s a lot of information to review! The January 2021 Interim Final Rule on Loan Forgiveness summarizes and has an extensive Q& A section that may be helpful if you have questions. It’s also 62 pages long so be prepared to settle in to read it.

On page four you’ll see a list of documentation you must keep to verify your eligibility for forgiveness. This includes payroll documentation and nonpayroll documentation (if you use nonpayroll expenses to qualify for forgiveness.)

If you get a second PPP loan, you must submit documentation of the 25% reduction in gross receipts.

Records Retention Requirement: Pay close attention here. You need to keep records in case the SBA audits your loan. It states:

“The Borrower must retain all employment records/payroll documentation in its files for four years and all other documentation for three years after the date the loan forgiveness application is submitted to the lender, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request. The Borrower must provide documentation independently to a lender to satisfy relevant Federal, State, local or other statutory or regulatory requirements or in connection with an SBA loan review or audit.”

This article was originally written on October 9, 2020 and updated on July 29, 2021.

This article currently has 31 ratings with an average of 4.5 stars.