Critical Analysis of Section 37 of the Income Tax Act, 1961

Explanations to Section 37(1) inserted from time to time for clarifying the intent of the legislature.

Explanation 1

- Inserted vide Finance Act, 1998 w.r.e.f. 1-4-1962.

- Expenses related to offences or prohibited activities are inadmissible.

Explanation 2

- Inserted vide Finance Act, 2014 w.e.f. 1-4-2015.

- CSR Expenditure not allowable.

Explanation 3

- Inserted vide Finance Act, 2022 w.e.f. 1-4-2022.

- Further Clarification on Explanation 1.

2. Conditions for Allowability under Section 37 of the Income Tax Act

Expenditure shall be allowed in computing the income chargeable under the head “PGBP“, if it satisfies following conditions Cumulatively:

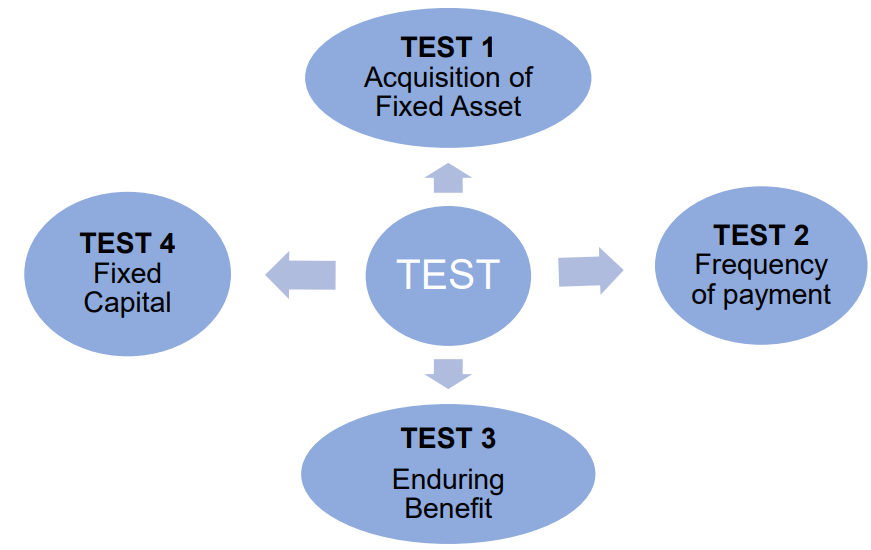

- it is Not an expenditure of the nature described in Sections 30 to 36

- it is Not in the nature of Capital Expenditure

- it is Not in the nature of Personal Expenses

- it is laid out or expended Wholly and Exclusively for the purposes of the business or profession

Explanations 1, 2, 3 to be Considered

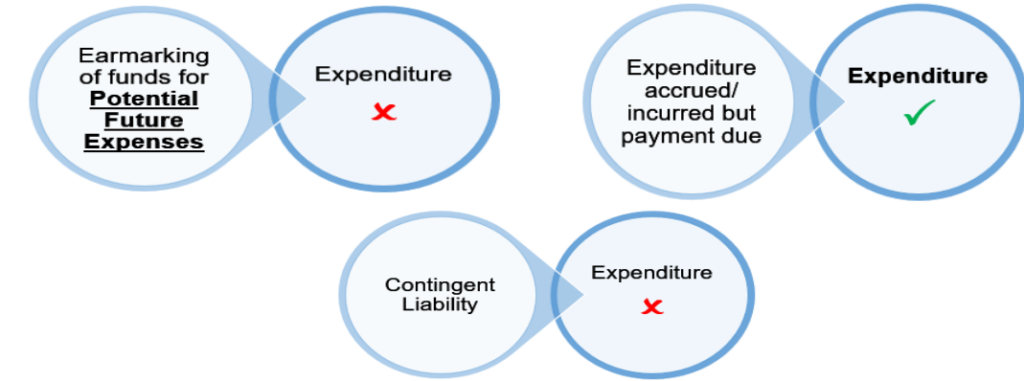

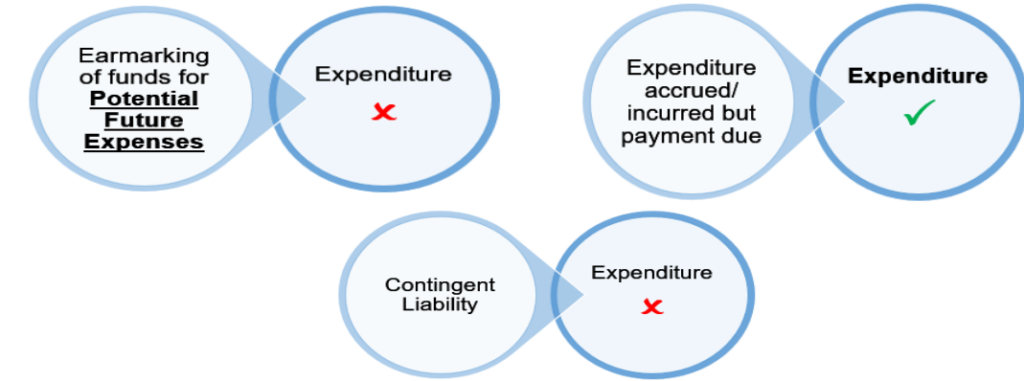

2.1 Meaning of Term ‘Any Expenditure’

- Allowance under Section 37 is granted to ‘Any Expenditure’ that meets the criteria outlined in Section 37(1).

- Core definition of ‘expenditure’ revolves around the concept of ‘Spending‘ indicating the act of ‘Paying Out or Away’ of money. In essence, ‘expenditure’ denotes the Irreversible Outflow of Funds.

2.2 ‘Expenditure’ vs. ‘Loss’

Distinction exists between “disbursement/expenditure” and a “loss”.

Expenditure:

- Consciousact of paying out or spending.

- Deliberate choice for outflow of resources.

Loss:

- Fortuitous or arises from external factors.

- Entirely involuntary i.e. loss occurs irrespective of a person’s will.

- Business Expenditure must be incurred “Wholly and Exclusively” for business for allowance, while a Business Loss, to qualify, must be of a Non-capital Nature and not only connected with the trade but also incidental to the trade itself.

- In the case of M. P. Financial Corporation v. CIT [[1986] 26 Taxman 42/[1987] 165 ITR 765 (MP)], it has been observed that the term “expenditure” may, under specific circumstances, encompass:

- an amount that essentially represents a loss;

- even if that amount has not gone out of assessee’s pocket.

- The phrase ‘any expenditure’ within Section 37 of the Income Tax Act is interpreted to include both:

- ‘expenses incurred’ and

- amount classified as ‘losses’,

even if such amount has not gone out of assessee’s pocket

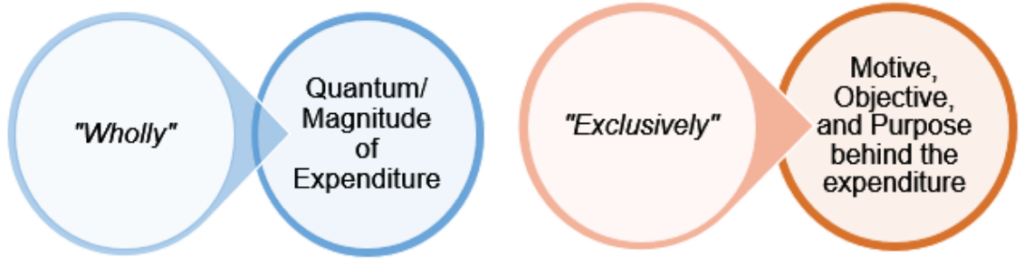

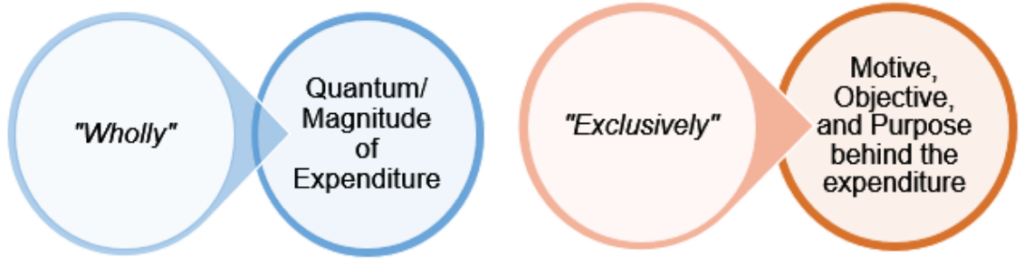

3. Meaning of ‘Wholly and Exclusively for the Purpose of Business’

- Phrase “Wholly And Exclusively” does not equate to “Necessarily”

- Assessee to determine Whether a Particular Expenditure is Warranted in the conduct of business.

- Expenditure may be undertaken Voluntarily and Without Absolute Necessity.

- State of Madras vs. G. J. Coelho [(1964) 53 ITR 186 (SC)] – established test stating that expenditure incurred under a transaction closely intertwined with the business can be considered an integral part of conducting the business.

- Bombay Steam Navigation Co. (1953) (P.) Ltd. vs. CIT (1965) 56 ITR 52 (SC) – Expenditure may qualify as revenue expenditure, laid out wholly and exclusively for the purposes of the business.

- S. A. Builders Ltd. vs. CIT(A), [2007] 158 Taxman 74/288 ITR 1 (SC) – Phrase “for the purposes of the business or profession” as employed in Section 37(1) encompasses a broader scope than the expression “for the purpose of earning profits”.

- CIT v. Delhi Safe Deposit Co. Ltd. [1982] 8 Taxman 1/[1982] 133 ITR 756 (SC) – True test of an expenditure laid out wholly and exclusively for the purposes of trade or business is it is incurred by the assessee:

- as Incidental to his Trade;

- for the purpose of Keeping the Trade Going and of making it pay and;

- Not in Any Other Capacity Than That of a Trader.

3.1 Questioning Expenditure’s Reasonableness: Possible?

- It is not for the revenue to question the Commercial Expediency of the expenditure.

- Commercial Expediency is a matter entirely left to the judgment of the assessee [CIT vs. Globald Motor Service (P.) Ltd. (1975) 100 ITR 240 (Mad.); CIT vs. Sapthagiri Traders Ltd. [2009] 180 Taxman 605/[2008] 305 ITR 438 (Mad.); CIT vs. Textool Co. Ltd. [2009] 184 Taxman 217/315 ITR 91 (Mad.)].

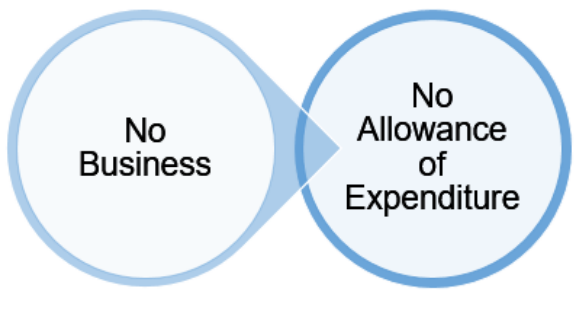

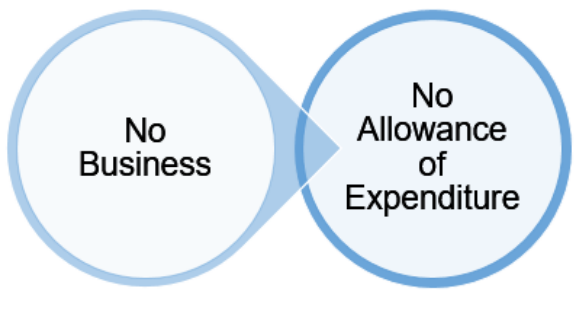

3.2 No Business, No Allowance

If during the relevant period, there was no business, the question of allowability of expenses would not arise [S.P.V. Bank Ltd. vs. CIT [1981] 5 Taxman 155/[1980] 126 ITR 773 (Ker.); J. R. Mehta vs. CIT [1980] 4 Taxman 522/126 ITR 476 (Bom.)].

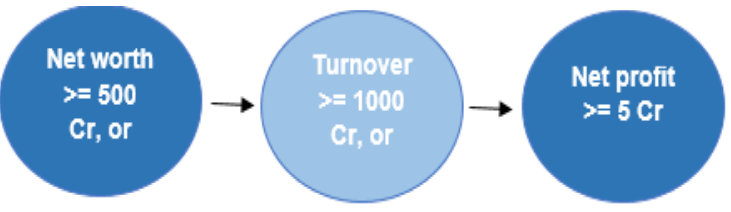

4. CSR Expenditure – Section 37 vs. Section 80G

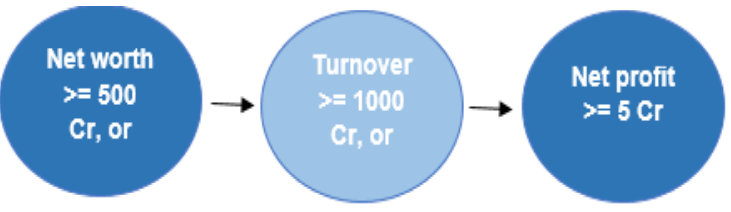

- Section 135 of the Companies Act, 2013 – Applicability

To Be Seen With Reference to Immediately Preceding Financial Year